The continuous surge in artificial intelligence is expanding into broader fields. DC Holdings has firmly seized this historic opportunity and is now entering a rapid growth phase. It has gained significant attention and recognition from both professional research institutions and well-known domestic and international investment banks and brokers.

Jefferies maintains a “buy” rating on DC Holdings

In the capital markets, internationally renowned investment bank Jefferies is optimistic about the future development of DC Holdings. In its latest research report, it maintains a "buy" rating for DC Holdings and raises the target stock price to HKD4.30. The report states that driven by smart computing-related businesses, the company's big data business has achieved strong growth in the number of customers and the average unit price, with an overall revenue increase of 11% in the second half of 2023, and a big data business revenue increase of 42%, exceeding expectations. Jefferies believes that the company's rapid expansion in overseas markets, with overseas revenue doubling in 2023 and accounting for more than 15%, is expected to bring higher growth rates and greater gross profit contributions in the future, becoming a new growth engine. In addition, the company was included in the CSI Hong Kong AI Index and the CSI Hong Kong Stock Connect AI Index, and it is expected that the stock liquidity will also increase significantly. The Xingye Research Center, which has been at the top of the New Fortune list for several years, is also optimistic about DC Holdings, maintaining a "buy" rating, and is more optimistic about the company's future development prospects. Industrial Securities believes that the company's main business is healthy and growing steadily, with incremental breakthroughs in big data business and an increasingly optimized business structure. The layout in smart computing centers, data intelligence applications, and overseas markets provides the company with broader development space. It is expected that the company's revenue for 2024/2025 will be RMB19.4/20.4 billion, and the net profit attributable to the parent company will be RMB 510/540 million. This year's first quarter, the performance of all DC Holdings' businesses is very notable. DC Holdings is forging ahead in the wave of artificial intelligence with its forward-looking vision, excellent technical strength, and unremitting innovative spirit, becoming a leader in the industry. Looking forward to the future, DC Holdings will further promote the application of artificial intelligence in various fields, injecting new momentum into economic and social development. It is believed that DC Holdings will continue to lead in the field of artificial intelligence and create an even more brilliant future.

.png)

Industry Accolades and Standards

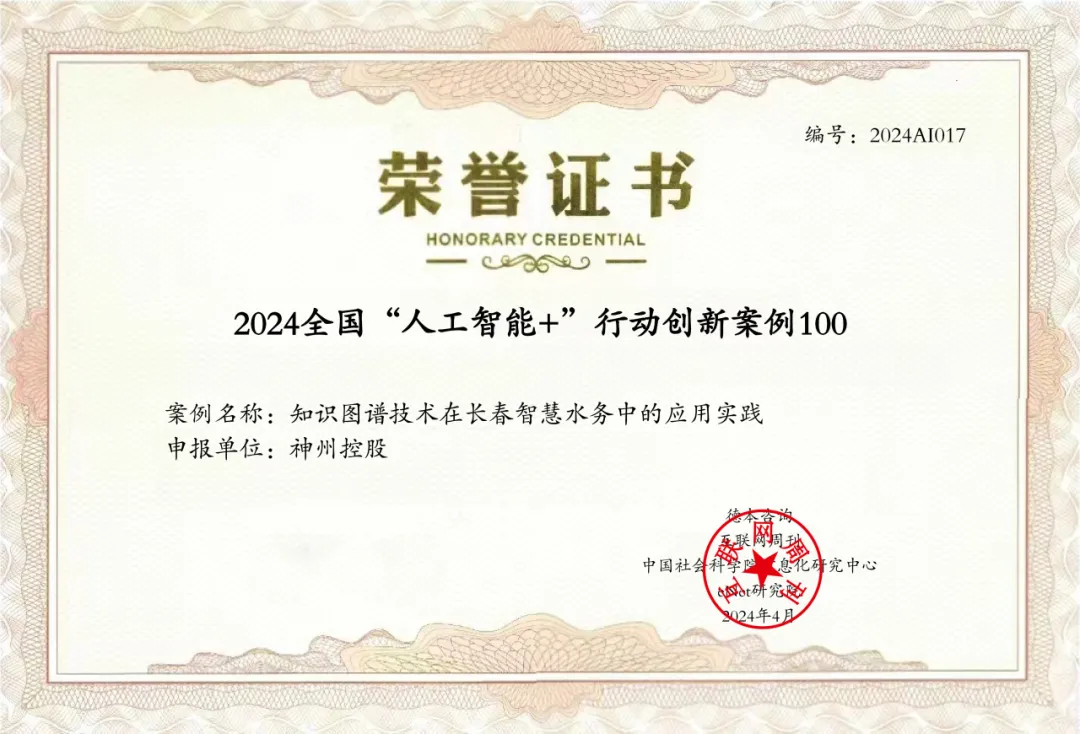

Recently, DC Holdings was awarded the title of "Top 100 New Quality Productive Force Benchmark Enterprise" in the field of new generation information technology, ranking second. Moreover, the company's knowledge graph technology application practice in Changchun Smart Water Affairs was successfully selected as one of the "2024 National 'Artificial Intelligence +' Action Innovation Case 100",becoming a domestic industry benchmark in the field of new quality productivity and "Artificial Intelligence +". The development of new quality productivity was been included into the "Government Work Report" for the first time in 2024, becoming one of the key tasks of this year's economic and social work. At the same time, the government work report clearly proposed to carry out the "Artificial Intelligence +" action, providing DC Holdings with an opportune moment to leverage its extensive expertise and experience.